Webinars

12th March 2026

11:00AM EST | 3:00PM GMT

Future-Ready Private Credit: Scaling Operations, Intelligence, and AI for 2026

Implementation lessons from building a centralized data platform in a private credit environment

20th August 2025

Ended

From Wall Street to Main Street: How PE and M&A are reshaping Banking

Gain valuable insights into the trends, challenges, and opportunities shaping the future of finance. Whether you're an investor, finance professional, or simply curious about the evolving role of private equity in banking, this session is packed with expert perspectives you won’t want to miss.

8th August 2025

Ended

Is AI Really Disrupting Private Markets?

AI is no longer just a theme — it’s the infrastructure and operating system of private equity.

1st August 2025

Ended

Decoding Capital: The Rise of Operating Partners in the Middle East

As sovereign funds scale up their private equity ambitions across the Middle East, the role of Operating Partners and Fund Operators has quietly become one of the most strategic levers in deal success.

18th July 2025

Ended

Why Private Equity Deals Are Getting Bigger — and Riskier — in Mid-2025

Private equity deals are getting bigger, but fewer. Rising capital, tighter regulation, and longer timelines are reshaping the market.

10th July 2025

Ended

Navigating Credit Monitoring and Portfolio Management in Private Credit

Current situation in direct lending, BSLs, and secondariesTrends in credit monitoring and portfolio managementHow automation helps address key challenges

18th June 2025

Ended

Unlocking Hidden EBITDA: Automating Cloud Cost Optimization for PE-Backed Companies

Uncover hidden EBITDA through automated cloud optimization Cloud spend is often a hidden drag on portfolio company profitability. ProsperOps' autonomous discount management results in immediate EBITDA gains. Learn how automation delivers higher ROI and eliminates the need for manual tuning or forecasting.

30th April 2025

Ended

Ready to Grow: Navigating the Challenges in the Pricing and Valuation Process for Multi-Strategy Managers

Managing pricing of 12000+ securities every day across different FAS Levels Streamlining the governance process and moving to an exception-based model

3rd April 2025

Ended

Next-Gen Private Credit Operations: Balancing Tech and Human Expertise in Portfolio Management

The Digital Shift: Redefining the Role of Portfolio Management Teams Talent & Technology: Equipping Private Credit Professionals for the Future

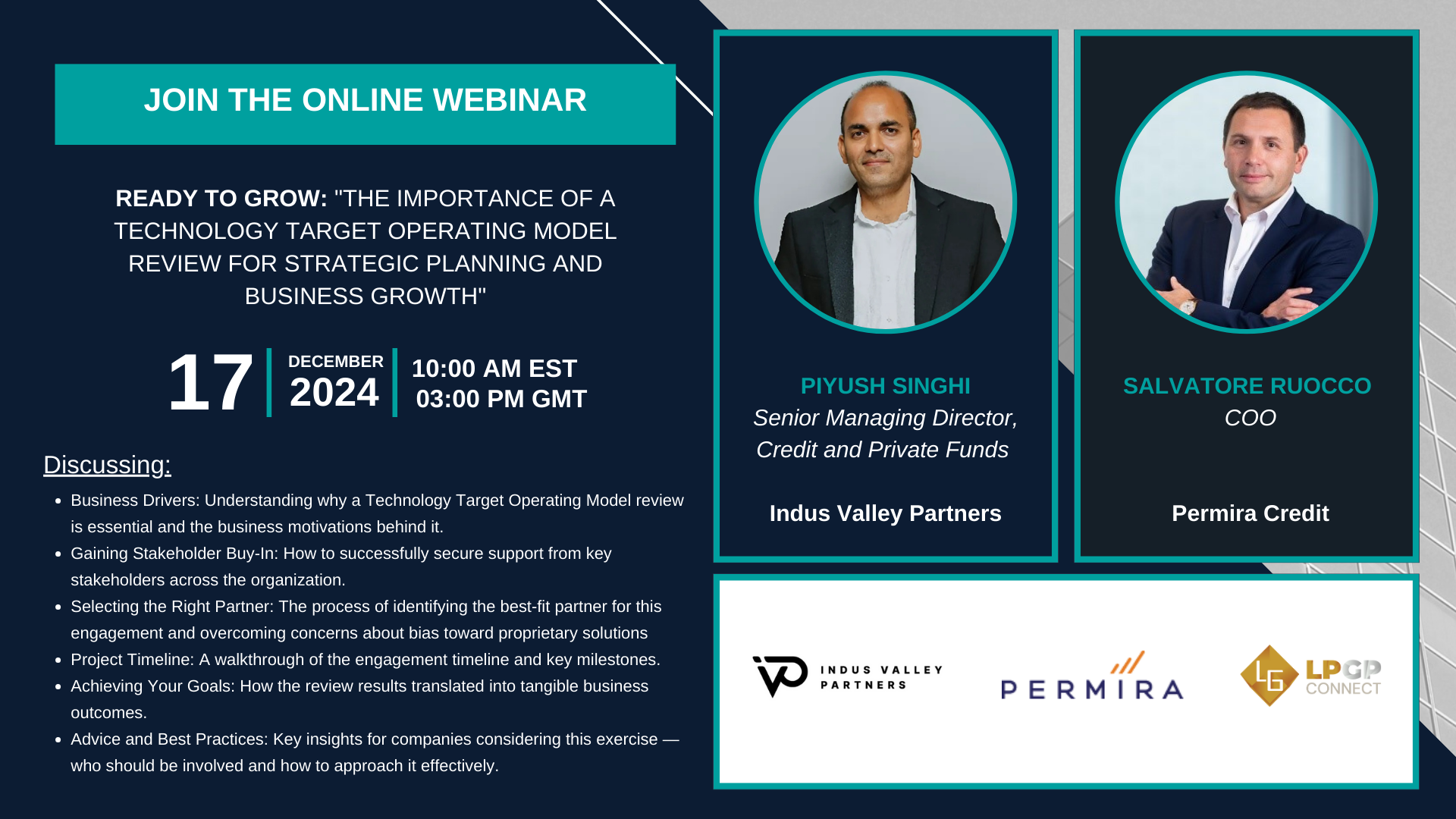

17th December 2024

Ended

Ready to Grow: The Importance of a Technology Target Operating Model Review for Strategic Planning and Business Growth

Business Drivers: Understanding why a Technology Target Operating Model review is essential and the business motivations behind it. Gaining Stakeholder Buy-In: How to successfully secure support from key stakeholders across the organization.

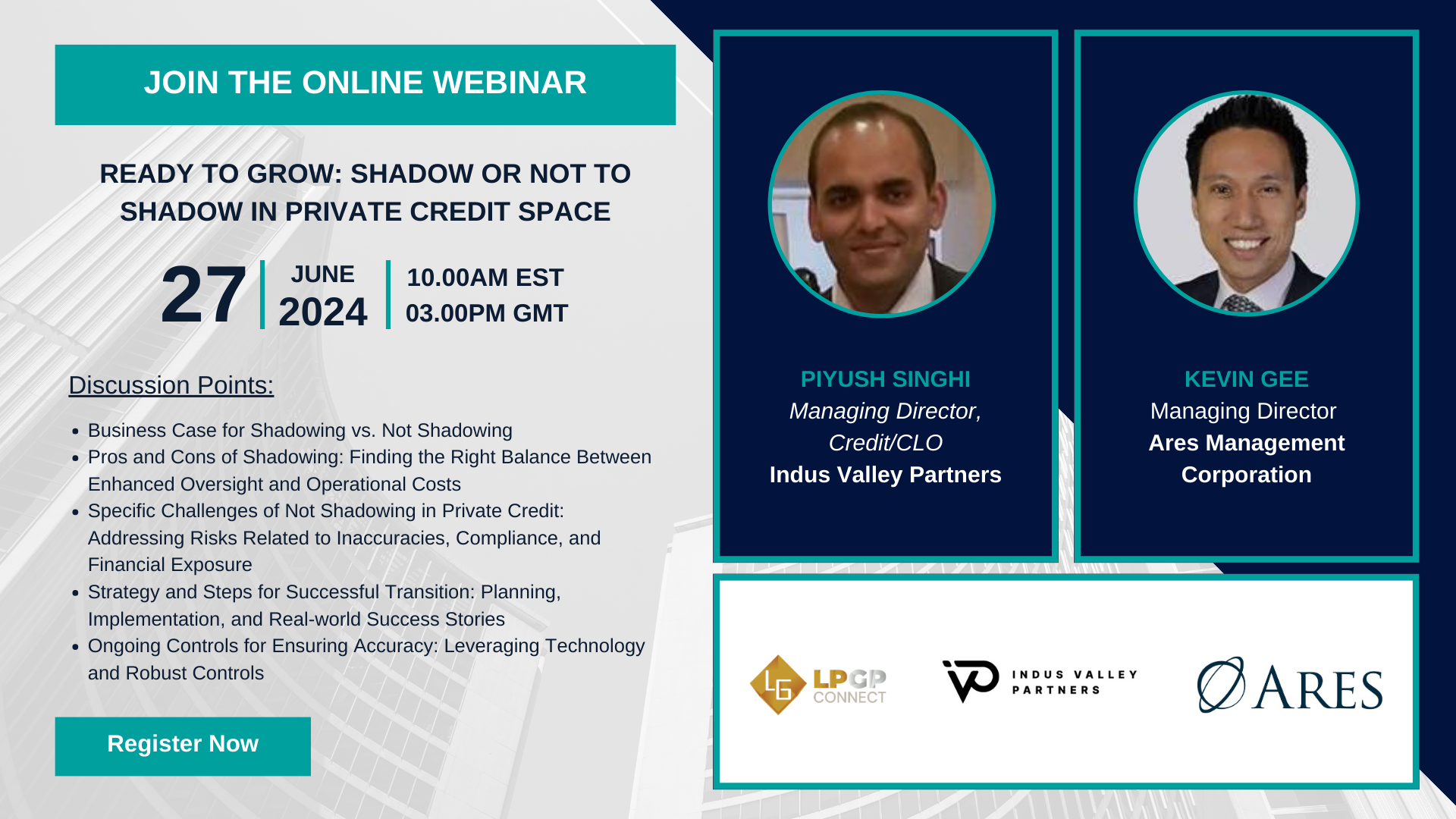

27th June 2024

Ended

Ready to Grow: Shadow or Not to Shadow in Private Credit Space

Business Case for Shadowing vs. Not Shadowing Pros and Cons of Shadowing: Finding the Right Balance Between Enhanced Oversight and Operational Costs

22nd May 2024

Ended

Navigating Third-Party Administration for U.S. and Overseas Funds

Outsourcing: When to start considering third-party options Finding "the one" - How to select the right partner

17th September 2021

Ended

Recruitment: The Frenetic Hiring Pace of Private Capital

What are candidates most interested in? The primary drivers for turnover of PE executives and where they are going The most innovative methods to recruit candidates

28th April 2021

Ended

Spring Valuations Insights

What is the M&A outlook for 2H of 2021? What are the key trends and opportunities? What have we observed in European valuations during Q1 2021? What do we anticipate for 2021 valuations?

19th March 2021

Ended

Cybersecurity for Private Capital: Payment Fraud and Other Critical Risks GP's Need to Watch out for

Solarwinds impact on Private Capital The top risks for CFOs today

Get in Touch

We’d love to learn more about your goals and explore how we can create impactful events or PR strategies tailored to your brand. Reach out to start the conversation.

Contact Us